Donald Trump’s tax returns are here and deliver more burning questions about his money

Washington DC - Former president Donald Trump’s seven-year battle to keep the public from seeing his taxes ended in defeat on Friday as a House committee released six years of returns documenting his aggressive efforts to minimize what he paid the IRS.

Trump and his wife, Melania, paid $750 or less in federal income tax in 2016 and 2017, and zero in 2020, according to the returns released by the House Ways and Means Committee, which oversees tax legislation.

In three other years, Trump paid significant amounts of taxes, although as a share of his income, the amounts were far below those of the average taxpayer. The returns show he paid $641,931 in 2015, just under $1 million in 2018, and $133,445 in 2019.

The 2018 payment came on reported adjusted gross income of $24.3 million - an effective tax rate of 4%. By contrast, the average taxpayer in 2018 paid $15,322 in federal income taxes, with an average rate of about 13%, according to the IRS.

The order of the release of the returns - redacted to hide Social Security numbers and other private information - marked the final act of a saga that outlasted Trump's presidency and included two trips to the Supreme Court as Trump resisted public disclosure of his financial records.

The disclosures raise multiple questions about whether Trump's tax strategies simply took advantage of the law or broke it.

Donald Trump is not such a great businessman

Republicans, who denounced the release of the returns as a violation of Trump's privacy, are unlikely to inquire further once they take over the Ways and Means committee in January. But in the Senate, where the Democrats continue to have a majority, leaders of the Finance Committee have indicated they may pick up where the House Democrats left off.

During the years in which Trump battled disclosure, much of the information he sought to keep secret about his pre-presidential finances became public anyway, largely from a 2020 New York Times investigation.

The picture that emerged showed that for all Trump's claims to be a great businessman, his core businesses - a sprawling network of hotels, golf courses, and other properties - has lost millions of dollars year after year.

"He's a staggering loser," said Steven M. Rosenthal, a senior fellow in the Urban-Brookings Tax Policy Center.

The newly released records, covering 2015-2020, add to that picture.

While many of his business ventures operated at a loss, Trump received a large amount of income from his reality television show The Apprentice, and from other efforts to license his name. He also received steady income from a real estate partnership in which he has a partial ownership interest, but no management authority.

As Rosenthal and others point out, it's not clear how much of the negative income reported by Trump on his tax forms can be attributed to actual business losses as opposed to aggressive use of tax rules.

The returns do not appear to disclose any nefarious sources of income - contrary to speculation over the years by some of Trump's opponents.

How did Donald Trump manage to pay so little in taxes?

One widely used strategy that Trump took extensive advantage of involves carrying over losses from one year to reduce tax liability in another. In 2015, for example, Trump carried over an operating loss of $105.2 million. Such carryovers, smaller but still in the tens of millions, continued in subsequent years, until they apparently were used up in 2018 with a carryover of negative $23.4 million.

The source of those carryover losses from 2015 to 2018 is thought to be a $700 million loss posted by Trump in 2009. In a report on Trump’s taxes, the House committee noted that these carryover losses need to be verified, and there are indications that the IRS may still be looking at whether the massive 2009 loss was valid.

Trump's ability to zero out his tax liability highlights the extremely favorable treatment the real estate industry receives under tax law, as well as strategies that he and other wealthy individuals use to minimize what they must pay.

Beyond the carryover losses, the returns also show a pattern of questionable claims, the committee report noted, including large business-expense and charitable deductions that in some cases lack documentation: financial transactions with three of his children - Ivanka, Donald Jr., and Eric - that the committee report said may have been "disguised gifts," and millions of dollars in write-offs related to an estate that Trump owns in the New York suburbs.

He initially claimed the estate, known as Seven Springs, as a personal residence, then reclassified as a business investment in 2014. The IRS is investigating whether that claim is valid, according to the committee.

The tax returns show a number of other cases, small and large, that were flagged by congressional staff. In one schedule for the 2015 tax year, Trump reported a $50,000 speaking fee that was almost entirely offset by $46,162 in claimed travel expenses.

The House committee also revealed that the IRS had not put Trump's returns under audit during the first two years of his presidency, and when it finally did so, it didn't provide enough resources to fully answer questions about Trump's claims.

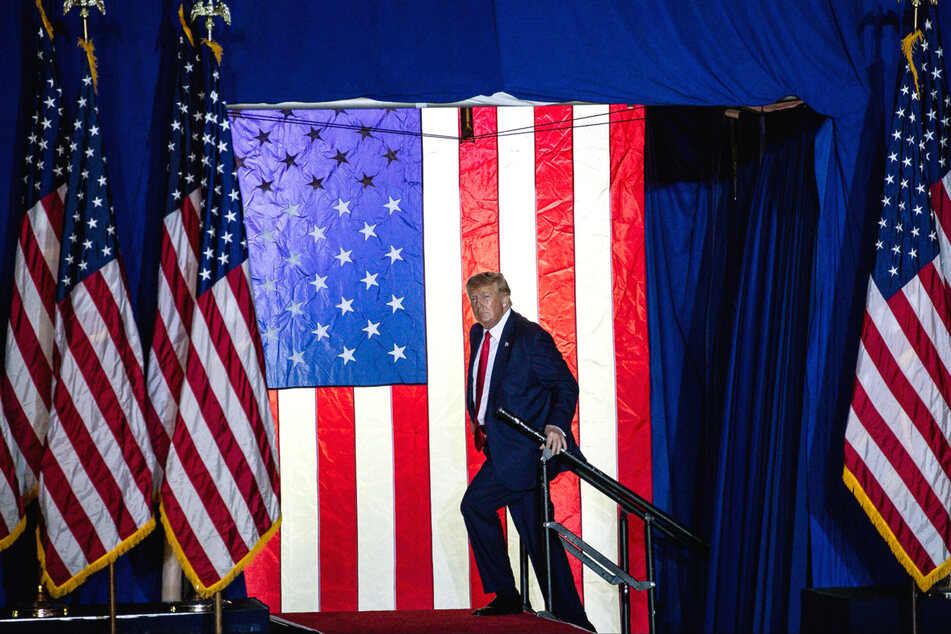

Cover photo: Imago/UPI Photo